Hauptlinks

Suchen

How to end the Graphics Card Crisis

Exaggerated retail prices for desktop graphics cards have been with us for over a year – and are now possibly even about to disrupt the gaming market permanently. A quick resolution of the situation seems unlikely, and even the risk of a continuation of this situation with the upcoming 5nm graphics cards beyond 2022 has to be considered in the meantime. By means of this article, two measures in favor of decreasing graphics card prices to a normal level will be outlined, which (presumably) have a greater chance of actually resolving this messy situation.

It's not just a matter of gamers being able to buy gaming graphics cards at reasonable prices. The implication of the permanent price exaggerations ultimately affects the entire industry around PC gaming: Because at the currently called graphics card prices, the interest in this hobby simply reduces or people looks for other ways. Whether this consists of withdrawing from PC gaming or switching to game consoles is irrelevant. Ultimately, this undermines PC gaming as a whole – and with it, game development as well as further development for it. For this much larger industry, the PC is currently still a leading platform – but this could change if the high graphics card prices become established and subsequently more and more users turn away from this platform. Other hardware manufacturers are also likely to feel the effect if PC gamers drop out as the usual drivers of development.

The starting point of the current graphics card crisis is the coincidence of the two factors "digitalization push" by means of the Corona pandemic and the measures that followed it, as well as the increasing lucrativeness of cryptomining from the end of 2020, in particular of Ethereum (ETH), of course. From a pure demand side, cryptomining is certainly much more powerful, but the effect of the digitization push from the Corona pandemic had a significant impact on the supply side: Because all manufacturing capacities (for all other possible chips) are fully booked industry-wide, it is correspondingly more difficult to simply build more graphics cards. Only the coincidence of these two effects could trigger such a long-lasting effect on graphics card retail prices.

The permanent overpricing situation has then led to a significant number of actually pending graphics card purchases being postponed, and users are thus waiting for viable graphics card prices to a large extent. However, this only increases the problems of the graphics card market – because as soon as the retail prices drop considerably, this pent-up demand is added (and again has a price-driving effect). This could only be solved by drastically increasing supply and/or drastically reducing demand. There are two ways of achieving this in the required amount:

Increase the supply side: Two graphics card generations at the same time

Supplying more always seems like the simplest solution, but it's not so easy to put into practice – especially not in the graphics card business with its long production pipeline. A certain increase in delivery volume is possible by tapping into existing reserves: Chip production can be increased by using previously underutilized production lines or by making yields more effective. Even in times of fully utilized production facilities, all this still brings a few percent more in delivery volume, which can be sent to the market. However, nVidia in particular has already done this over the year 2021, as a unit number statistic of the desktop graphics cards shipped suggests:

| Desktop GPUs | AMD | nVidia | overall | share |

|---|---|---|---|---|

| Q3/2019 | ~2.8 million units | ~7.7 million units | ~10.5 million units | 27.1% vs. 72.9% |

| Q4/2019 | ~3.7 million units | ~8.1 million units | ~11.8 million units | 31.1% vs. 68.9% |

| Q1/2020 | ~2.9 million units | ~6.6 million units | ~9.5 million units | 30.8% vs. 69.2% |

| Q2/2020 | ~2.2 million units | ~7.9 million units | ~10.1 million units | 22% vs. 78% |

| Q3/2020 | ~2.6 million units | ~8.9 million units | 11.5 million units | 23% vs. 77% |

| Q4/2020 | ~1.9 million units | ~9.1 million units | 11.0 million units | 17% vs. 83% |

| Q1/2021 | ~2.4 million units | ~9.4 million units | 11.8 million units | 20% vs. 80% |

| Q2/2021 | ~2.3 million units | ~9.2 million units | 11.47 million units | 20% vs. 80% |

| Q3/2021 | ~2.7 million units | ~10.0 million units | 12.72 million units | 21% vs. 79% |

| Basis of all figures: Jon Peddie Research — missing values interpolated (marked by "~") | ||||

AMD, on the other hand, has the problem that too many chip projects are being realized at the same time at the same chip manufacturer (TSMC) – and graphics chips probably have the lowest priority at the moment. Nevertheless, AMD has also increased its graphics card output recently, although not yet (in contrast to nVidia) beyond the pre-crisis level. The so-called "low-hanging fruits" are already gone, though, so further production increases would only be possible via additional production capacities (aka new chip factories) – which are simply not available at the moment or would usually take years to be built up and put into operation.

The only chance for a really big leap in production capacity is therefore when a transition in production technology is imminent – such as at the end of 2022 with the switch from 7/8nm to 5nm production. Normally, this does not mean a capacity gain because the switch is simply from the old to the new production. The older graphics card generation based on the old production technology is then usually discontinued, because it is not as efficient as the new generation and thus quickly no longer economical enough for the manufacturer. As soon as the graphics chip developers give up the capacities of the older production, those usually go to new tasks – which means that these capacities cannot be reclaimed.

At the time of the transition, however, there is also the possibility of NOT phasing out the capacities of the older production (in this case, specifically TSMC 7nm at AMD and Samsung 8nm at nVidia) at the chip manufacturer – but to continue producing these old graphics chips (alongside the new graphics chips). This would allow almost double the amount of graphics chips to be produced, and old and new production should largely not interfere with each other. Of course, graphics card buyers will primarily rush to the new 5nm graphics cards – but the continuing supply of 7/8nm graphics cards would have a price-reducing effect on all market offerings. By means of the double supply, the pent-up demand mountain could be reduced, which would immediately become active at reasonable graphics card prices.

Of course, this idea is not easy to realize: The capacity planning for the chip manufacturers is certainly done several quarters in advance. AMD & nVidia would have to inform their chip manufacturers early enough that they do not want to do without the existing 7/8nm capacities even when the 5nm capacities appear – otherwise the chip manufacturers will allocate these 7/8nm capacities elsewhere. In addition, AMD and nVidia would of course also have to clarify whether enough other materials can be organized to build a temporarily (up to) double amount of graphics cards – boards, smaller chips and graphics card memory are needed. If their production expansion shouldn't be possible, this idea becomes obsolete.

In general, AMD & nVidia might not be easy to warm up to this idea: This is an absolutely unusual approach, which even with an initial success always brings the risk of producing millions of chips from older production too much, which one can no longer sell at some point. After all, it takes a good half a year before a graphics chip is ordered, manufactured, processed into a graphics card, delivered around the world and finally sold to the consumer. AMD and nVidia would have to continue the production of Ampere and RDNA2 graphics cards at their own risk – and when it is recognized that their sales should come to an end, the chip manufacturer will still supply them for a few months.

In addition, the graphics chip developers might also lack the willingness to act so clearly against the exaggerated graphics card retail prices. AMD & nVidia currently only earn a fraction of the exaggerated prices – graphics card manufacturers, distributors & retailers likely to divide the largest part among themselves. But the longer this scheme runs, the more higher graphics card prices become the norm – which is only beneficial for the vendor side and is exploited more and more by the graphics chip developers via higher list prices (and thus a bigger share of the pie for themselves). Honestly, it has to be said that the idea of a drastic expansion of supply by two graphics card generations at the same time results in too little (short-term) profit at a not insignificant risk for those who would have to carry it out – AMD & nVidia.

Reducing the demand side: Banning resource-hungry cryptomining

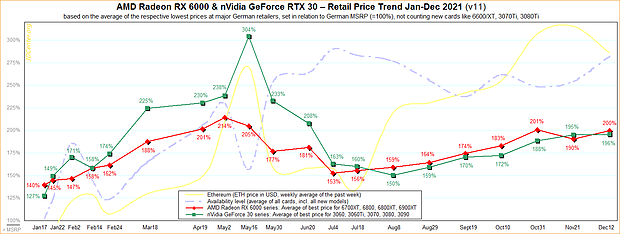

Especially the graphics card market has, at least in theory, the possibility of a substantial demand reduction, which does not go the "natural" way of higher prices: If the cryptominers are missing as buyers, the recently already increased additional deliveries might be enough to reduce the pent-up demand in the foreseeable future. It is unclear to what extent the crypto miners are really involved in the current graphics card sales – i.e. whether 20%, a third or even half of all graphics card deliveries go to the cryptominers. What is clear, however, is the clear price correlation between graphics card prices (red & green lines) and Ethereum price (yellow line) over the year 2021:

The exclusion of cryptominers from the graphics card market has been attempted in many ways, none of which has proven effective so far: nVidia's mining limiter has been broken as known, usual retail limitations in the form of giving only one graphics card per shipping address are ineffective if the cryptominer orders directly in the middle of the supply chain. Even if such measures were to work, it is ultimately impossible to control what end users do with their graphics cards anyway: Use them for mining or put them up on eBay for the cryptominers to strike. As long as cryptomining is profitable, it will always find a way to get the necessary hardware.

Thus, the only possibility is to push down the profits from cryptomining sufficiently so that mining is no longer worthwhile and this enormous hardware requirement does not arise in the first place. However, this plan is not so easy to implement, especially in the area of blockchain-based cryptocurrencies, since their inherent principle is to be able to continue to exist independently of market interventions and (attempted) regulations. Once the genie is out of the bottle, it will not return to it. Simple, direct bans would therefore be largely ineffective – especially if one were to attack the crypto industry head-on and all cryptocurrencies simultaneously.

What does seem possible, however, is targeted regulation: On the one hand, these must provide the crypto industry with a positive way out, and on the other hand, they must be applied at points that cannot easily resist state intervention. As a possible regulatory measure, one can mention a future general ban on resource-hungry cryptomining-based cryptocurrencies. The objective of this ban (to be threatened) is that the cryptocurrencies in question refrain from mining for its own sake and introduce other ways of remunerating transactions – such as staking (PoS). Moreover, this proposal should please be understood in its entirety – if one of the mentioned components is missing, the whole thing will not work anymore:

|

➔ "future"

An immediate ban would not only be unrealistic, but would above all provoke too much resistance. If, on the other hand, the ban is threatened with a corresponding grace period, then enough cryptocurrencies will be persuaded for its own sake to switch from mining (PoW) to staking (PoS). This alone would achieve a lot, and it would also weaken the power of resistance of the "unwilling" cryptocurrencies. ➔ "resource-hungry cryptomining" The objective must lie solely in cryptocurrencies with considerable waste of resources, whether in the form of hardware or/and energy. This means that not all cryptocurrencies are affected, which reduces the potential for resistance to this regulation from the outset. This restriction can also be combined well with all the "green" agendas and would thus be easier to communicate to politicians, media & citizens. ➔ "general ban" Logically, a direct ban on cryptocurrencies would not achieve much. However, if the ban also covers the activities of holding, managing and trading, this would primarily target the ecosystem of trading platforms and apps for cryptocurrencies. These usually do not want to get into trouble with the law and are likely to remove cryptocurrencies declared as "illegal" from their offerings. |

The latter point contains the real power of this proposal: If we look at the ecosystem around cryptocurrencies, (successful) regulation is quite conceivable. Already today, most of these platforms are forced to query and hold extensive identification data for new customers. Because unlike a blockchain, which exists purely as a virtual entity, crypto platforms are usually companies based somewhere quite real – which don't want to have their business disrupted by trouble with the law. There will always be exceptions, but even these will want to become legal at some point – especially if the regulatory pressure continues to increase over time.

But if you have these platforms in control, then the battle is already won, regardless of whether it is still technically possible to mine. Because if the vast majority of trading platforms simply exclude such "forbidden" cryptocurrencies, a transfer to other cryptocurrencies or even real money is only possible with difficulty, and even their possession would be illegal (i.e., the tax office would confiscate a balance without replacement, upon knowledge), then these types of cryptocurrencies will first collapse very thoroughly. Whether it subsequently continues at underground on a (significantly) smaller level would be almost meaningless – especially with regard to cryptomining. Of course, this regulation must be approached cautiously – and especially the large cryptocurrencies should be treated like raw eggs and possibly even shape their regulation in direct cooperation with them.

This is exactly why the ban must be in a certain future, so that the cryptocurrencies in question precisely do not go into resistance, but choose to leave mining on their own (as well as receive the necessary time to do so). In the case of Ethereum it is even simpler: A threatened ban would help to force the execution of the long existing plans for a switch to the "Proof of Stake" principle – and even if this switch should be delayed again, its implementation can at least not longer be averted. As soon as this changeover has been achieved, other cryptocurrencies are likely to follow, new ones will not even start mining – and thus also undermine the getaway of cryptominers into other mining currencies than Ethereum. Whether or not smaller cryptocurrencies with mining principles retreat into the underground would ultimately not matter – the broad masses are unlikely to take the path into illegality if platforms and apps refuse to cooperate.

As interesting as this idea may sound, its real implementation is (unfortunately) unlikely. Ultimately, this would be a legislative, i.e. political, project – for which political interest and political majorities would first have to be organized. In German politics, which is behind the moon in IT matters, there is no potential for this – at best, the EU will be equipped with billions to conjure up new chip factories without sense. A certain potential is to be seen in the US politics, where there are at least already law advances against scalper prices. Otherwise, only an NGO could accomplish this work, because a huge amount of persuasion work will have to be done with politics & media before the comparatively easy to create legal text.

In other words: Simple solutions are not on offer. There probably can't be any in view of the messy situation in the graphics card market. But if you don't want to hope that the price exaggerations will evaporate by themselves over time – which could well take years – then there are only solutions that move the really big adjusting screws and are thus never easy to realize. This article does not pursue thereby also the requirement to offer solutions, which are realistic from the conditions. Solutions were offered, which presumably work – but only if it is really wanted by who have to carry it out (graphics chip developers and/or politics).

Translated into English from the original article in German language with the help of DeepL and Google Translate. Please excuse any inaccuracies by the translation.